how much does a property tax lawyer cost

For standard commercial closings on small multi-family properties a real estate attorney may cost 1500 2500. A tax attorney is a lawyer who specializes in tax law.

How To Lower Your Property Taxes Wsj

Hourly fees for tax attorneys range from under 200 to over 450 per hour depending on a firms reputation a lawyers experience and other factors such as geographic.

. Trial Cases Can Run 5000-15000. A lawyer often charges between 100 and 400 per hour for their. For example lets break down the cost of employing a mid-level property Lawyer below.

Importantly some attorneys charge different rates. The general rule of thumb is that the bigger the law firm the higher costs. For many other sorts of cases particularly tax issues an hourly fee is a typical approach to charge.

The average hourly cost for the services of a lawyer ranges from 100 to 400 per hour. How much does a property tax consultant cost. For simple cases that require only a modest amount of legal representation you can pay.

Tax attorneys help with planning compliance and disputes. My property tax friends across. As you can see a 140000 salary quickly expands to 240000 in total cost.

Understand the different tax laws that apply to yoursituation. Most property tax consultants charge their customers on a contingency basis which means that they work for free unless they end up. After our 1 fee your first.

Taxes lawyers are required to charge gst and pst on all fees and most disbursements. However this is not necessarily true if a small firm solely specializes in bankruptcy cases. You might also expect that lawyers charge higher rates as they gain more experience.

A tax attorney provides legal advice to individuals. Tax attorneys cost 295-390 per hour on average. Your gross savings will typically be around 25 per year of the reduction we obtain.

Our study bore out that expectation with average minimum and maximum rates. Nov 6 2019 on average a tax attorney costs about 300 per hour with average tax lawyer fees ranging from 200 to 400 in the us for 2019. How Much Does a Tax Lawyer Cost.

To negotiate small agreements with the IRS you can pay from 700 to 1500. How much does a property tax lawyer cost. It is important to note that some attorneys charge well above this average up to as much.

We have seen a reduction last for multiple years after a successful protest. The cost of having a business lawyer set up and form your llc for you can be. Although each tax attorney will charge their own hourly rate you can expect to pay anywhere between 200 and 400 per hour.

Attorney Cost for a Commercial Real Estate Transaction. Heres a quick breakdown of the average prices tax attorneys charge for common tax services hourly or flat fee.

8 Steps To Appeal Your Property Tax Bill Kiplinger

What Factors Affect Your Property Taxes And How Much You Pay

Real Property Gains Tax Rpgt In Malaysia 2022

What Type Of Lawyers Make The Most Money Lawrina

1 Tds On Sale Of Property Under Section 194ia In 2022

General Sales Taxes And Gross Receipts Taxes Urban Institute

Lawyers Fees Types Of Legal Fee Arrangements Law Firm In Metro Manila Philippines Corporate Family Ip Law And Litigation Lawyers

:max_bytes(150000):strip_icc()/taxes_due-6bb60b22f93948bbb123e098ecbf5d21.jpg)

Top 9 Tricks For Lowering Your Property Tax Bill

Hecht Group Appealing Your Property Taxes How Much Does It Cost To Hire A Lawyer

:max_bytes(150000):strip_icc()/renting-vs-owning-home-pros-and-cons.asp-ADD-V2-2ce9de919eb94f62bd4e4c7a23010852.jpg)

Renting Vs Buying A Home What S The Difference

Property Taxes And Your Mortgage What You Need To Know Ramsey

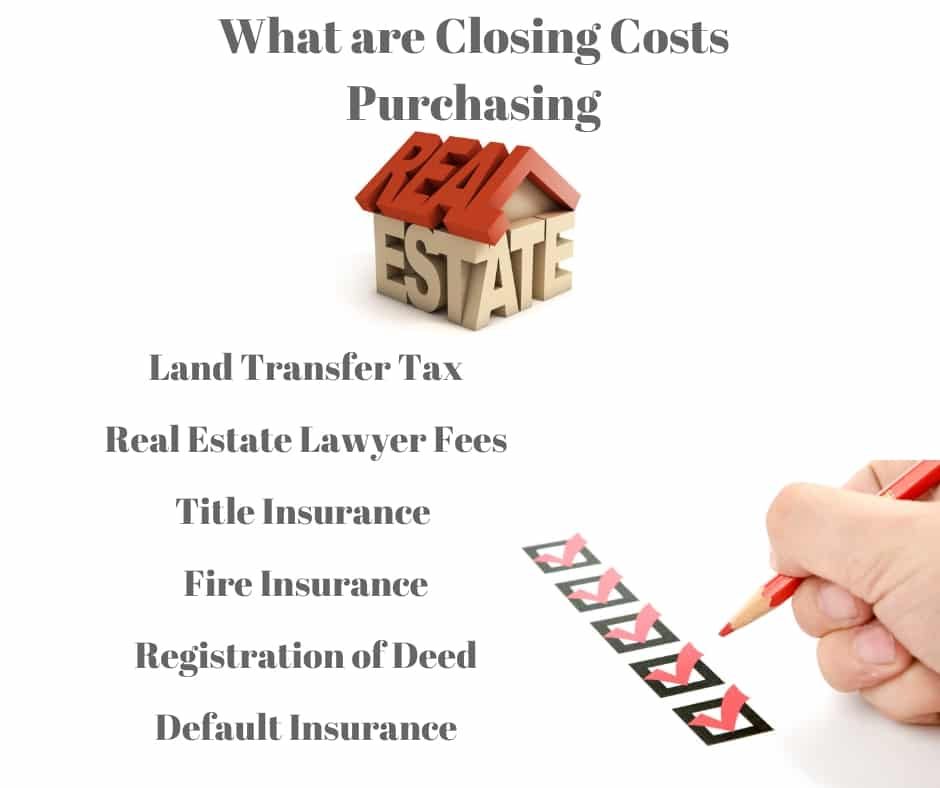

Closing Costs Ontario You Must Know Before Buying Or Selling Property

2022 Attorney Fees Average Hourly Rates Standard Costs

Kevin Sayles Lawyers Title Insurance Understanding Your Property Tax Bill What Is A Mello Roos Fee A Mello Roos Fee Is A Separate Charge On A Property Tax Bill In Addition To

How Much Do Tax Attorneys Make Accounting Com

Assessed Value Vs Market Value What S The Difference Forbes Advisor

Criminal Defense Lawyer Cost 2020 Average Attorney Fees

How To Appeal Your Property Tax Assessment Bankrate

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips